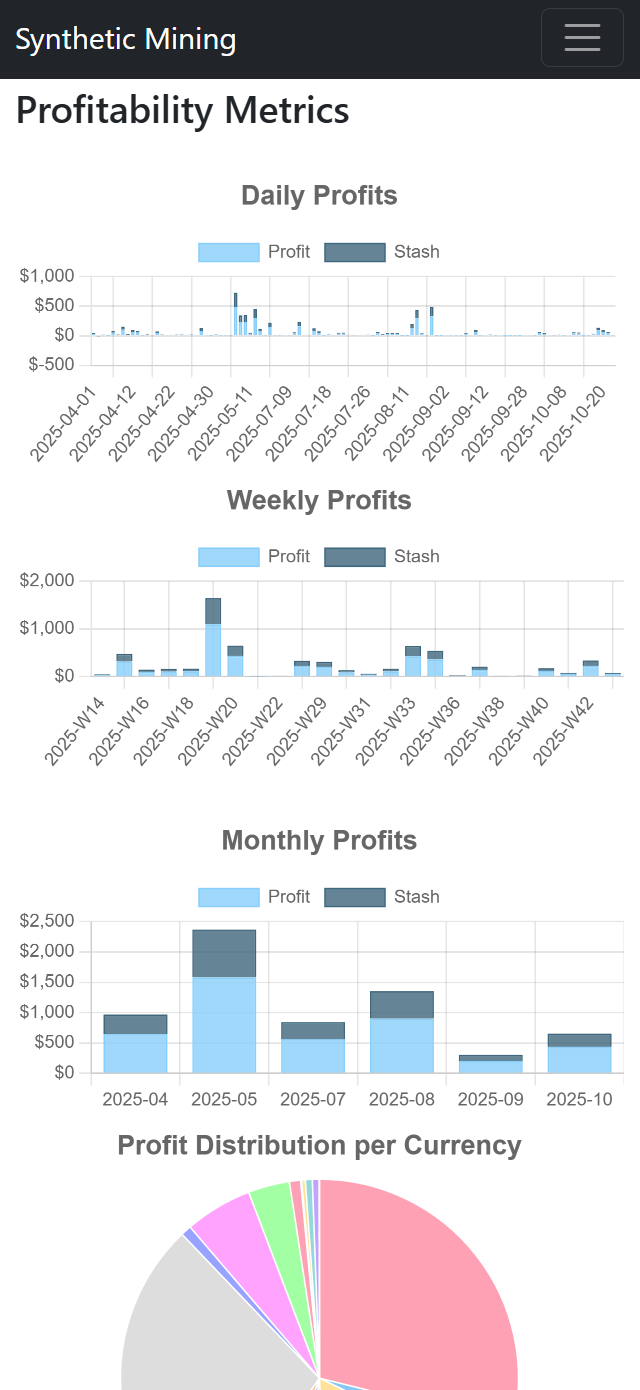

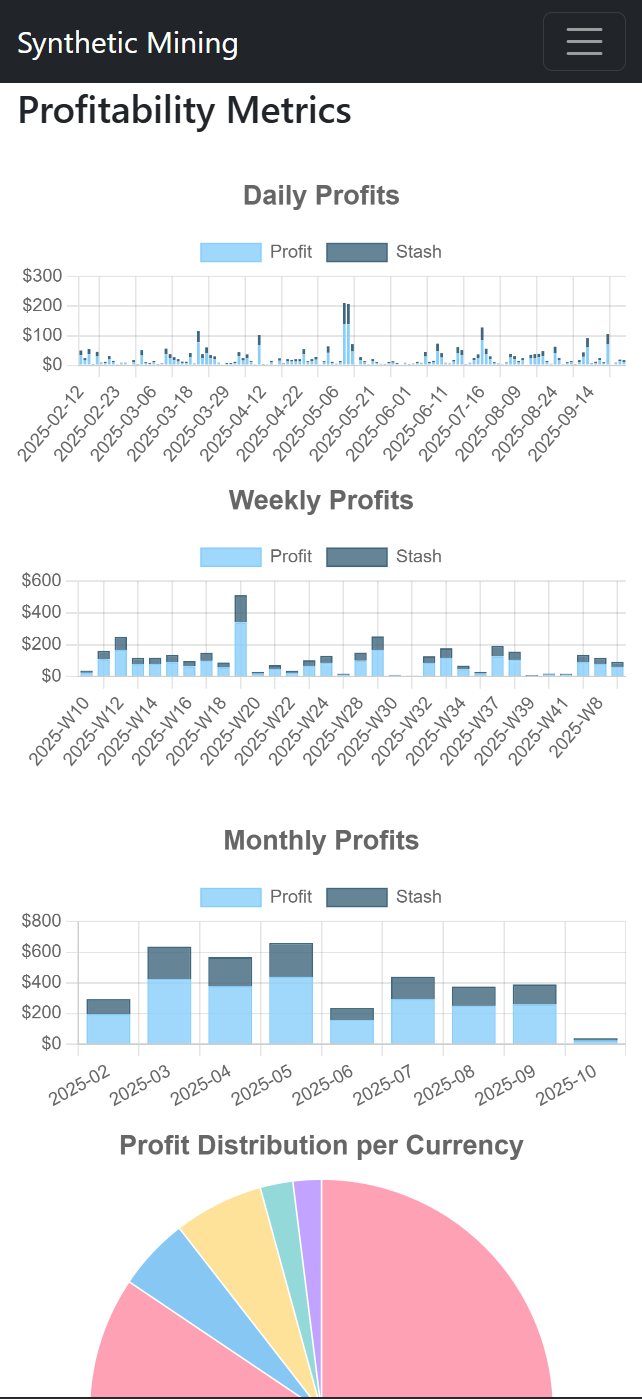

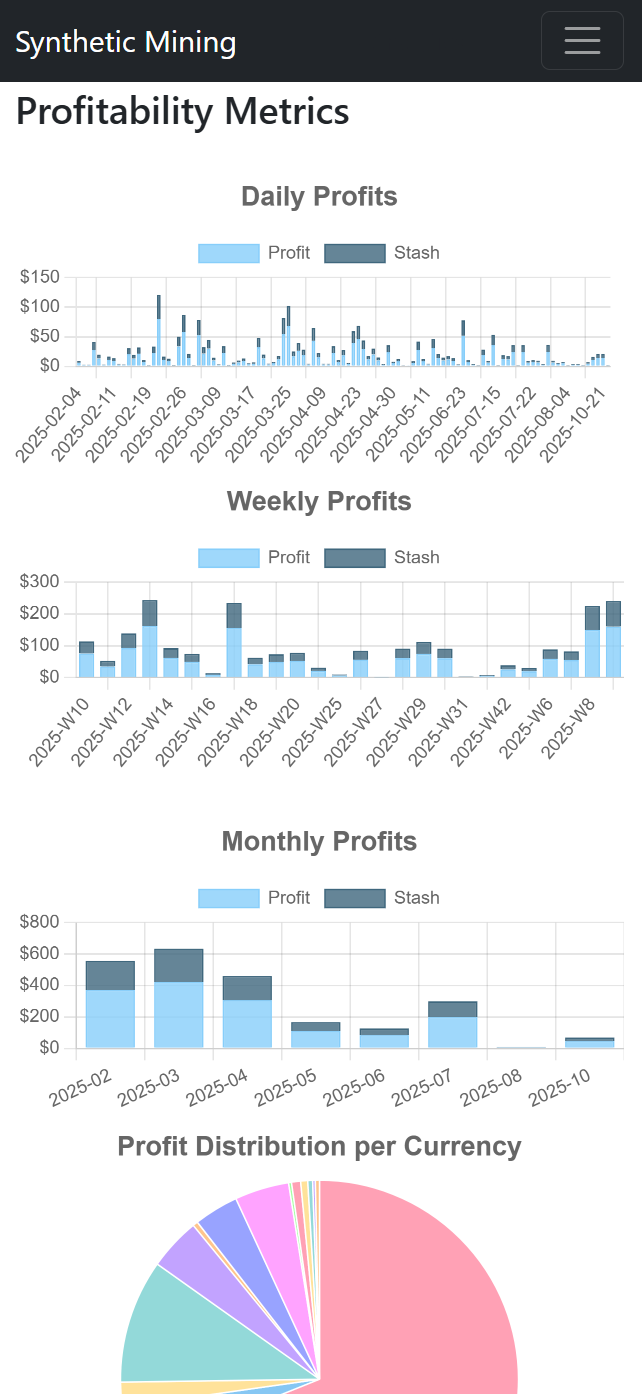

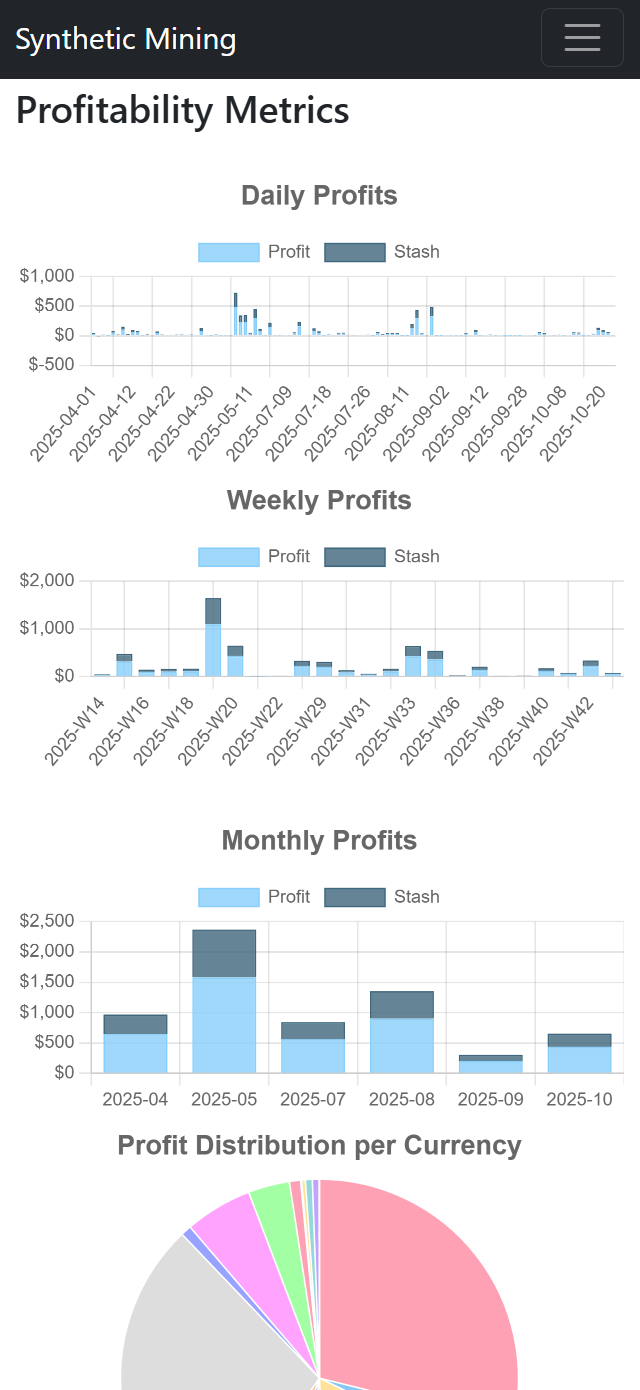

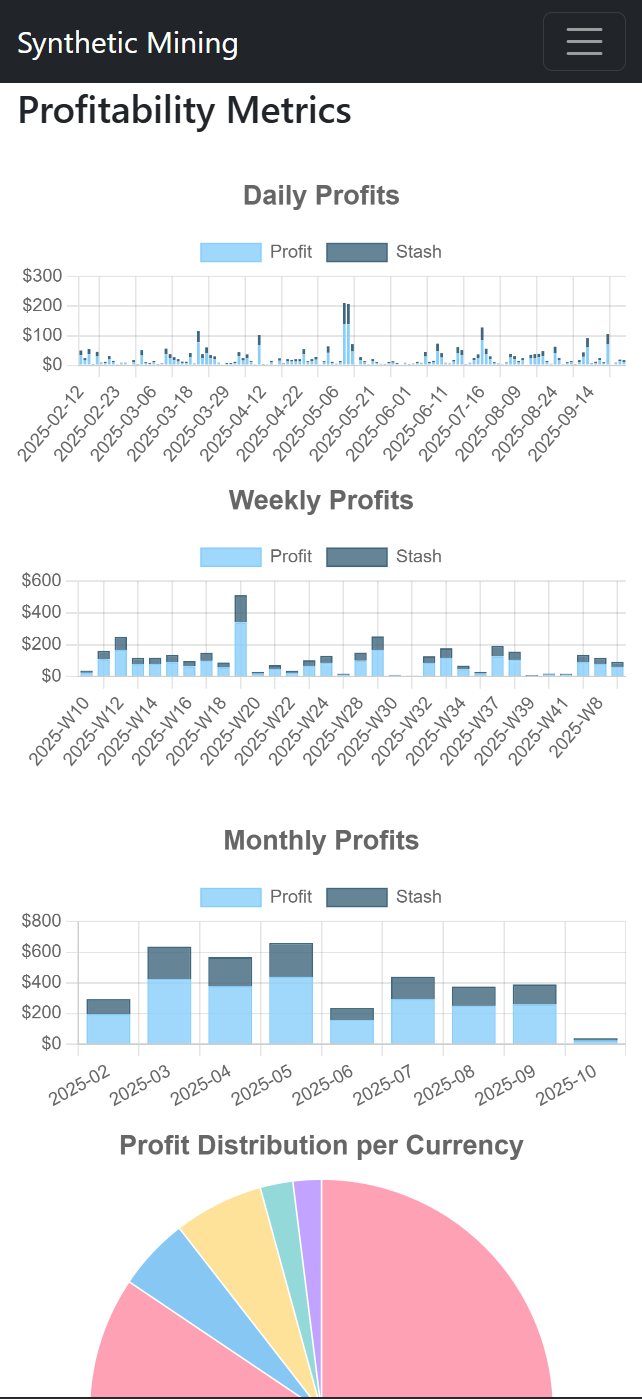

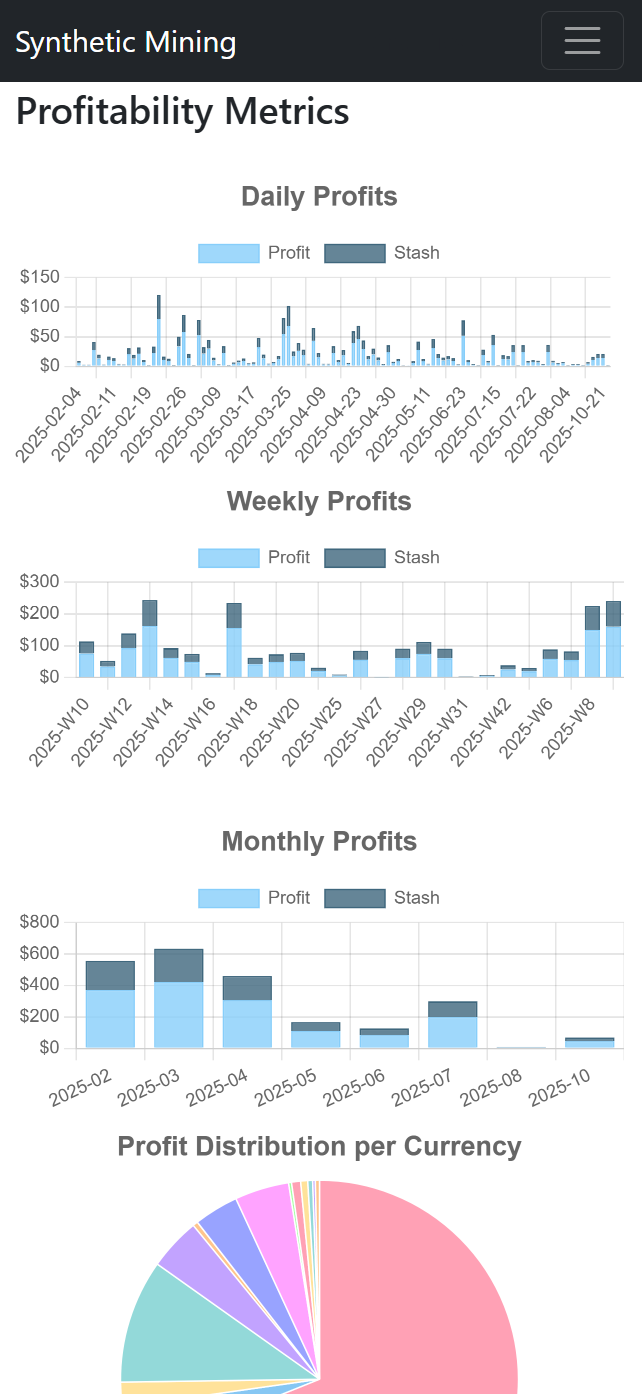

Real Results

Actual earnings from our subscribers since January 2025

Automatically grows your crypto stack 24/7 using smart grid trading—buying low and selling high while you sleep.

No hardware. No chart-watching. No stress. Just deposit funds in your own exchange account, configure your settings, and let our bot do the work.

Try it risk-free: If you don't earn back your subscription fee before your next billing cycle, just cancel—no questions asked. Starting at $19/month

Unlike traditional bots that make one big trade, we deploy up to 100 micro-miners per crypto pair. Your capital is diversified across many small positions—never 100% stuck.

Learn How It WorksYour money stays in YOUR exchange account. No leverage, no margin, no liquidation risk. We only have API trading access—we can't withdraw your funds.

Security FAQOur members have accumulated thousands in crypto since January. View actual screenshots and earnings from our 800-member community.

See Results| Feature | Traditional Mining | Synthetic Mining |

|---|---|---|

| Startup Cost | $1,000-$10,000 Money spent on depreciating hardware |

$1,000 Money deposited in YOUR exchange |

| Monthly Cost | High electricity bills | $19-$799/month |

| Maintenance | Hardware failures, repairs, noise, heat | Zero - we handle everything |

Actual earnings from our subscribers since January 2025

Choose your tier and start accumulating crypto today

1 Crypto Pair

$50 Max Spend

Perfect for testing the system

5 Crypto Pairs

$125 Max Spend

Best for serious accumulators

10 Crypto Pairs

$250 Max Spend

For diversified portfolios

20 Crypto Pairs

$25,000 Max Spend

For high-volume traders

If you don't earn back your subscription fee before your next billing cycle, just cancel—no questions asked.

You only pay for what delivers results. Simple as that.